Got any commercial space?

soCommercial is the most flexible & deal driven marketplace to buy, sell & rent, any type & size of commercial space.

List for free any type of commercial space from just small room to an entire building.

List anything, big, small, whole or part spaces, in over 100+ categories including; bars, restaurants, offices, malls, stores, warehouses, clinics, salons, billboards, parking, studios, farms, fields, mobile vending & more.

Get deals done fast by creating unique offers, vouchers & incentives & create new business opportunities.

Don’t delay get listing today!

Miami-Dade County, Florida, 33131

Size: 885 sq. ft.

Price: $690,000

Brickell Office Space for Sale

Prime office space in the heart of Brickell Business District! This stunning commercial office suite spans 885 usuable square feet. Positioned on a corner, the office is filled with natural light through out large windows in three separate rooms, creating a bright and welcoming environment. The space features a spacious reception area, ample space for files & supplies. Parking is available at $227.64 per-month per vehicle, unit has access to 2 parking spaces. Easy access to major roads, Metro Rail, Metro Mover, High-end Residential condos and hotels nearby. Enjoy Brickell's vibrant dining, shopping, and business hubs just steps away, in an ideal location to elevate your business presence. Tenant occupied until October 2027 $47 P.S.F. Rental Rate. Investors only. New carpet installed.

Omaha, Nebraska, 68144

Size: 1,200 - 120,000 sq. ft.

Price: $10 - $22 per sq. ft. per annum

Lease in iconic mall

Redefining Destinations – Lease in a Space Built for Innovation & Engagement! The Mall is a prime investment and leasing opportunity focused on upscale retail, entertainment, and lifestyle experiences. With recent new tenant commitments, the property is experiencing increased leasing momentum, making it an ideal time for retailers, entertainment venues, and experiential brands to secure space. Positioned in a high-income trade area, the Mall is set to become a revitalized shopping, dining, and entertainment hub.

Key Highlights

Strong Demographics: High-income households & strong consumer spending.

Retail & Entertainment Destination: Ideal for fashion, dining, fitness, and luxury brands.

Leasing Momentum: New tenant signings increasing demand.

Experience-Driven Strategy: Focus on entertainment, fitness, and unique retail concepts.

Proximity to Major Employers: High daily foot traffic potential.

- Custom

We offer incentives based on square footage rented, we can offer free rent depending on lease, size and type of business.

- Rent

Discounted rents possible tailored to type of business and length of lease.

- Service Charges

Possible service charge discounts to eligible businesses.

Incentives

126 NW 33rd St, Miami-Dade County, Florida, 33127

Size: 1,822 sq. ft.

Price: $1,390,000

Income-Generating Wynwood Property

Seize the opportunity to own a prime property in Wynwood! This income-producing gem features a main house with 3 bedrooms, 2 bathrooms, plus a separate 1-bed, 1-bath guest house complete with its own kitchen and laundry amenities. Explore the potential of Airbnb and booking rentals, or dive into development with zoning for up to 17 units across four floors (T4R zoning). Located near Miami's top attractions, from the Design District to Brickell and Downtown, this property offers both immediate income and long-term development possibilities. Dive into Wynwood's dynamic real estate scene today!

Omaha, Nebraska, 68144

Size: 400,000 sq. ft.

Price: $7,500,000

Cap 10%+ Trophy Mall

The Mall is a prime investment and leasing opportunity focused on upscale retail, entertainment, and lifestyle experiences. With recent new tenant commitments, the property is experiencing increased leasing momentum, making it an ideal time for retailers, entertainment venues, and experiential brands to secure space. Positioned in a high-income trade area, The Mall is set to become a revitalized shopping, dining, and entertainment hub.

Key Highlights

Strong Demographics: High-income households & strong consumer spending.

Retail & Entertainment Destination: Ideal for fashion, dining, fitness, and luxury brands.

Leasing Momentum: New tenant signings increasing demand.

Experience-Driven Strategy: Focus on entertainment, fitness, and unique retail concepts.

Proximity to Major Employers: High daily foot traffic potential.

📊 Market Overview & Demographics

Affluent Consumer Base: High disposable income and brand-conscious shoppers.

Lifestyle & Experience Demand: Growing preference for entertainment-driven retail.

Health & Wellness Trend: Increasing demand for boutique fitness, medical offices, and wellness services.

Dining & Social Venues: Consumers seeking high-quality restaurants and nightlife options.

106 N Evers St, Plant City, Florida, 33563

Size: 300 - 11,000 sq. ft.

Price: $15 - $25 per sq. ft. per annum

Downtown professional

🌟 Versatile Office & Retail Space in the Heart of Plant City

This 11,000 SF flexible commercial space is perfect for a variety of business uses, including professional offices, medical offices, retail, last-mile e-commerce, and coworking operations. Located in a high-visibility area with excellent accessibility, this property offers a modern and adaptable layout to meet the needs of growing businesses.

🔹 Key Features:

✅ Flexible Use – Ideal for professional services, medical, retail, or e-commerce fulfillment.

✅ Prime Location – Centrally located with high foot traffic and visibility.

✅ Spacious & Adaptable Layout – Open floor plan with potential for private offices or collaborative workspaces.

✅ Convenient street parking for staff and clients.

✅ High-Speed Connectivity – Ready for tech-driven businesses and coworking operators.

💼 Perfect For:

✔ Professional Services & Corporate Offices

✔ Medical & Wellness Practices

✔ Retail Showroom & Customer-Facing Businesses

✔ Last-Mile E-commerce & Fulfillment Center

✔ Coworking & Shared Workspace Operators

📞 Schedule a tour today to explore this exceptional leasing opportunity in Plant City!

- Custom

Discounts available for long term leases (5 y plus) for the whole property. Possibility to sublease for co-working operators.

- Rent

Possible discounts.

- Service Charges

Possible discounts.

Incentives

2201 Northeast 52nd Street, Broward County, Florida, 33064

Size: 4,000 sq. ft.

Price: $21 per sq. ft. per annum

Medical Office Space for Lease

Updated medical office space for lease in prestigious Lighthouse Point. This space includes large waiting and reception area, 6 exam rooms 2 executive offices with shower, lab room and kitchen area with ample covered parking. Located just blocks from the new Broward Health Emergency Center. B3-A Zoning would permit several other office uses including financial services, architectural and construction, and sales and marketing. Located in an area of high-income demographics.

10440 Southwest 186th Terrace, Miami-Dade County, Florida, 33157

Size: 11,100 sq. ft.

Price: $6,000 fixed price per month

Cutler Bay Truck Parking

Building Description

Fenced Industrial Lot for Lease – Prime Multi-Use Opportunity! One Sotheby’s International Realty is pleased to present a walled off 10,000 SF industrial lot available for lease in Cutler Bay, FL, offering an excellent opportunity for businesses seeking a flexible and well-located space for various industrial applications. Whether you need a site for storage, tow yard operations, equipment staging, fleet parking, or other industrial uses, this lot provides the space, security, and accessibility required to support your business needs. Conveniently situated at 10440 SW 186th Terrace, Cutler Bay, FL 33157, this property is located in a well-established industrial and commercial district, surrounded by warehouses, manufacturing facilities, and office parks, making it an ideal location for businesses that require proximity to key suppliers, distributors, and service providers. One of its strongest advantages is its prime accessibility, being just half a mile from Florida’s Turnpike, which ensures seamless connectivity to major transportation routes, facilitating efficient logistics and distribution operations. The fully fenced perimeter enhances security and privacy, making it an excellent choice for businesses that require a safe and controlled environment for their assets, equipment, or fleet. The lot’s industrial zoning allows for a wide range of uses, making it an adaptable solution for businesses looking to expand or establish a strategic base in a high-demand commercial and industrial corridor. With ample space, convenient access, and a strong location in an area known for industrial activity, this property presents a rare leasing opportunity for companies looking to optimize their operational efficiency. Secure a strategically located industrial lot that offers both convenience and versatility.

Building Highlights

Rate: $6,000 P/MO

SFT: 10,000

Tow Truck Operators: A fenced Industrial lot provides a secure storage area for towed vehicles

Equipment Rental Companies: Store heavy equipment, machinery, and tools in a secure and easily accessible location

Construction Companies: Use the lot for equipment and material storage, or as a staging area for projects

Landscaping and Lawn Care Services: Store equipment, trucks, and materials in a secure and organized manner

Trucking and Transportation Companies: Park and store trucks, trailers, and equipment

Scrap Metal Recycling: Collect, process, and store scrap metal

Car and Truck Sales: Store inventory for car and truck dealerships

Equipment Maintenance and Repair: Use the lot as a repair and maintenance facility for heavy equipment and machinery

Disaster Response and Recovery: Store equipment and supplies for disaster response and recovery efforts

Environmental Remediation: Store equipment and supplies for environmental cleanup and remediation cleanups

Agricultural Services: Store equipment, supplies, and materials for agricultural businesses

Waste Management: Store waste collection equipment and supplies

Manufacturing and Fabrication: Use the lot for outdoor manufacturing, assembly, or fabrication processes

Government Agencies: Store equipment, supplies, and vehicle's for government agencies

770 Ponce de Leon, Miami-Dade County, Florida, 33134

Size: 9,000 sq. ft.

Price: $29.50 per sq. ft. per annum

770 Ponce de Leon

Building Description

ONE Sotheby's International Realty is proud to present an exceptional leasing opportunity at 770 Ponce De Leon Boulevard, ideally located in the heart of the Coral Gables submarket in Miami-Dade County, Florida. The second floor, comprising 9,000 square feet, is thoughtfully designed to accommodate modern business operations. Among its key features are 22 perimeter offices, two executive offices, a glass- enclosed conference room, and an open bull-pen area. Additionally, the space includes a large training center and a full kitchen, providing both functionality and convenience. Supporting advanced business needs, the building includes a dedicated IT room with two high-speed T-1 lines, ensuring reliable internet access, email, file sharing, and other essential applications. Tenants will also benefit from 40 dedicated parking spaces additionally parking is available in the building and off-street, along with signage rights for enhanced visibility. This upscale, four- story office building spans 60,939 square feet and offers premium office spaces to suit a variety of professional needs. 770 Ponce De Leon presents a rare opportunity in the high barrier- to-entry, infill market of Downtown Coral Gables. Positioned strategically between Interstate 95 and the Palmetto Expressway, with close proximity to the 836 Expressway and Miracle Mile, the property provides seamless connectivity and accessibility for businesses and clients alike. This exceptional location allows tenants to capitalize on the area’s significant rental income growth and value appreciation, driven by Coral Gables’ reputation as one of South Florida’s most desirable commercial submarkets.

Building Highlights

Rate: $29.50 P/SF

• Versatile Workspace: 9,000 Square Feet

• 22 perimeter offices, Two executive offices, Glass-enclosed conference

room, Open bull-pen, Large training center, One full kitchen

• 40 parking spaces

• IT room has 2 dedicated T-1. A T-1 is a high speed data transmission

line. Used by businesses to provide reliable, dedicated T1 service for

internet access as well as other applications including email, file sharing,

web hosting and more.

• Signage rights available

• 2nd floor available with or without furniture

4019 South Le Jeune Road, Miami-Dade County, Florida, 33146

Size: 2,980 sq. ft.

Price: $100 per sq. ft. per annum

Turn Key Coral Gables Restaurant

One Sotheby's International Realty is proud to present an exceptional restaurant space now available for lease at 4019 S LeJeune Rd., in the vibrant city of Coral Gables, FL. This prime 4,850 SF location offers 50 feet of prominent frontage on LeJeune Rd., providing excellent visibility in a high-traffic area. Ideal for restaurateurs looking to establish their presence in one of Coral Gables' most dynamic neighborhoods, this restaurant is move-in ready and perfectly suited for a thriving dining establishment. Don't miss the opportunity to lease in this sought-after location.

Facing SW 42nd Ave., also known as LeJeune Rd., the property has an average of 26,000 vehicles per day (VPD). LeJeune Rd. is one of the city's main arterial corridors connecting various neighborhoods and provides access to many popular destinations within the city and the surrounding areas of Miami-Dade.

Building Highlights

• Situated in Coral Gables, FL, the "City Beautiful," 4019 S LeJeune Road offers an exceptional restaurant space for lease, perfectly designed to attract a steady stream of patrons from the surrounding vibrant mix of residential, retail, and office buildings. This 4,850 SF space boasts 50 feet of prominent frontage on LeJeune Road, providing excellent visibility and accessibility for both drive-by and pedestrian traffic. Located just minutes from Merrick Manor, a premier luxury development featuring upscale residences and boutique shops, this property is ideally positioned to benefit from the area’s affluent customer base, making it a prime location for a successful dining establishment.

The interior layout is ideal for a bustling dining establishment, featuring spacious dining areas, and ample kitchen space to accommodate a variety of culinary concepts. Located in a highly dense residential area with affluent neighborhoods just across Bird Road, the restaurant benefits from a built-in customer base eager for local dining options. This prime location presents an outstanding opportunity for restaurateurs to lease a property that combines strategic positioning, aesthetic appeal, and a strong foundation for growth in one of Coral Gables' most desirable commercial and residential districts.

• 4019 S LeJeune Road benefits from numerous public transportation systems running directly through and in close proximity to the property. The MetroBus system has two separate directional routes, North-South and East-West, both crossing in front of the property, as well as the Miami Dade Metrorail station just half a mile away.

• - 50' frontage on LeJeune Rd.

- Very Walkable (85 Walk Score)

- Multiple options for public transportation

- Centered between commercial and residential areas

- Property is centrally located near the Miami International

Airport, Coconut Grove, Brickell, Downtown and Wynwood.

827 Southeast 1st Way, Broward County, Florida, 33441

Size: 1,226 sq. ft.

Price: $2,000 fixed price per month

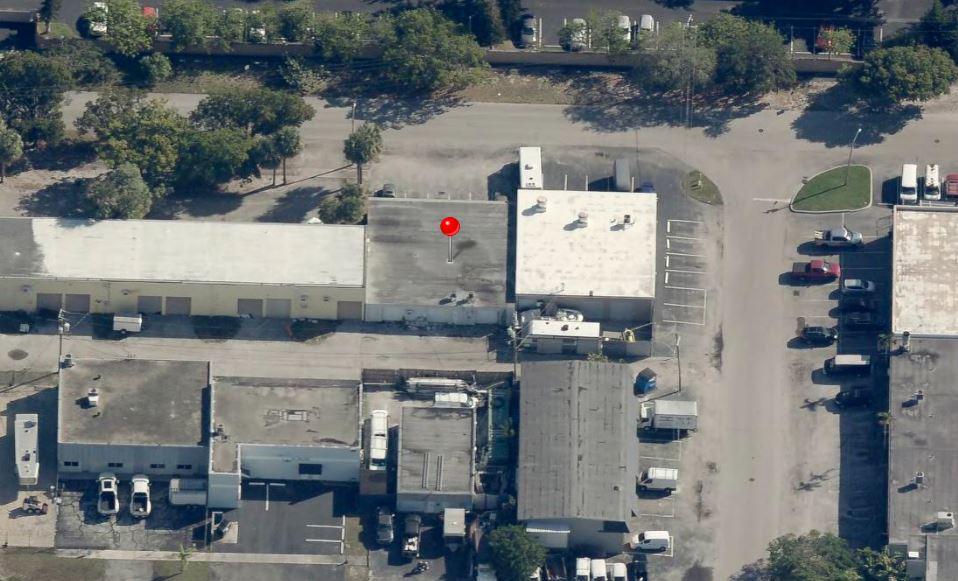

Small Bay Warehouse for Lease

Rare small bay warehouse for lease. Approximately 1,226 sq. ft. available for lease. This well located warehouse building centrally located in Deerfield Beach. This newly remodeled space include, customer waiting area 1 grade level door, 12’ ceiling heights. Desirable B3 zoning would permit storage, trade shops, metal work, woodworking, plumbing, roofing, electrical and associated building trades, contractors office, light manufacturing, and warehouse/ distribution.

2100 East Sample Road, Broward County, Florida, 33064

Size: 1,330 sq. ft.

Price: $429,000

Remodeled Medical Office Condo

Completely remodeled medical office condo for sale in prestigious Lighthouse Point. This condo includes large waiting and reception area with ample parking less than 2 miles from Broward Health North. This suite contains 3 private offices and conference room. Recent upgrades include new flooring, lighting, painting and ADA bathroom. Located in an area of high-income demographics

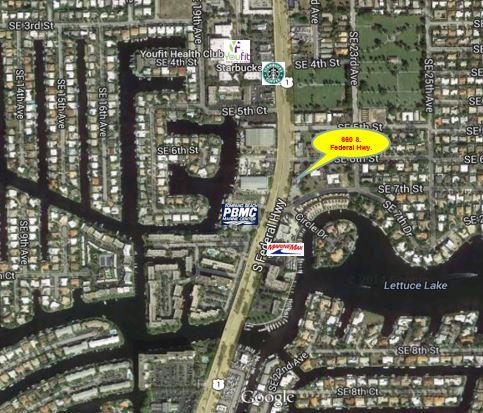

660 South Federal Highway, Broward County, Florida, 33062

Size: 1,250 sq. ft.

Price: $1,500 fixed price per month

Prominent Federal Hwy Office Space

Lowest priced office space on Federal Hwy!! Two suites available approximately 1,250 Sq. Ft. +- Interior recently remodeled for general office. Prominent features include 3-4 offices, private bathrooms and ample parking.

Park Rd, Miami, Florida, FL 12345

Size: 13,875 sq. ft.

Price: $4,900,000

Industrial Building

Explore this exceptional free-standing warehouse/industrial building, perfect for businesses looking to expand or for investors seeking a high-yield asset. This property offers versatility, excellent infrastructure, and a strategic location.

Ample Space: Large floor area with high ceilings, open layouts, and efficient design for various industrial or warehousing needs.

Prime Location: Situated in a thriving industrial hub with easy access to highways, ports, and public transit.

Well-Equipped Facility: Includes dock-height loading doors, drive-in bays, and robust electrical systems.

Office Space Included: Dedicated office areas for administrative needs, complete with modern amenities.

Flexible Zoning: Suitable for manufacturing, distribution, storage, or light industrial use.

Parking and Yard: On-site parking for staff and visitors, plus a spacious outdoor area for additional storage or maneuvering.

Investment Ready: Ideal for owner-users or as a tenant-ready investment property.

This stand-alone industrial building offers limitless potential to support your business operations or portfolio growth. Contact us today to schedule a viewing!

- Custom

The seller offers a leaseback opportunity on part of the warehouse for up to 6 months, providing guaranteed rental income during your transition period.

Incentives

3500 Pan American Drive, Miami-Dade County, Florida, 33133

Size: 1,400 - 3,500 sq. ft.

Price: $800,000 - $1,000,000

Medical Space Available in Miami

Modern Medical Building for Sale – Exceptional Healthcare Investment

This fully equipped medical building offers an unparalleled opportunity for healthcare providers and investors. Strategically located in a thriving area, it is ideal for clinics, diagnostic centers, or multi-specialty practices.

Prime Location: Situated in a high-visibility area, easily accessible from major highways and public transit.

Spacious Design: Well-designed layout with multiple exam rooms, offices, waiting areas, and treatment facilities.

State-of-the-Art Infrastructure: Equipped with updated HVAC, electrical systems, and plumbing tailored for medical use.

Ample Parking: Dedicated parking spaces for patients and staff, ensuring convenience.

ADA Compliant: Fully accessible design with elevators, ramps, and wheelchair-friendly features.

Nearby Amenities: Close proximity to pharmacies, labs, and other healthcare-related services for patient convenience.

This property is an excellent long-term investment for those in the medical field. Contact us now to schedule a tour and take the next step in elevating your healthcare practice!

- Custom

Purchase the property and receive existing medical equipment and furniture as part of the sale, saving setup costs (details upon request).

Incentives

7201 Tree Rd, Miami, Florida, FL 12345

Size: 6,958 sq. ft.

Price: $4,275,680

Prime Retail Building

Prime Retail Building for Sale – Exceptional Investment Opportunity

Discover this premium retail building, perfectly positioned to capitalize on high foot traffic and visibility. An excellent opportunity for investors, business owners, or developers looking to own a prime commercial property in a sought-after location.

Strategic Location: Situated in a bustling area with excellent exposure to both pedestrian and vehicular traffic.

Spacious Layout: Generous square footage with open-plan interiors, adaptable to various retail or business concepts.

Ample Parking: Convenient on-site and street parking for customers and employees.

Versatile Usage: Suitable for retail shops, restaurants, or mixed-use development.

Nearby Amenities: Close to shopping centers, public transit, and residential communities for consistent customer flow.

This retail building is an unmissable investment with endless potential. Contact us today for a private viewing and further details!

- Custom

Receive a $5,000 credit toward interior renovations or upgrades upon closing.

Incentives

Marina blvd., Miami-Dade County, Florida, 33154

Size: 11,000 sq. ft.

Price: $150 fixed price per day

Marina Space

Daily Marina Space Rental in Miami – Prime Location!

Looking for a convenient and secure place to dock your boat for the day? Our Miami marina space offers the perfect solution!

Location: Centrally located with easy access to top Miami attractions and open waters.

Amenities: Power hookups, freshwater access, and secure docking.

Convenience: Flexible daily rentals for hassle-free planning.

Extras: Close proximity to restaurants, shopping, and local marine services.

Reserve your marina spot now and enjoy Miami's vibrant waterfront lifestyle!

- Custom

Early Bird Discount: Book 7 days in advance and enjoy 10% off your daily rental rate.

Enjoy a free coffee at Marina Caffe! - Rent

Multi-Day Savings: Stay 3 days or more and get 1 day free!

- Voucher

Incentives

Lane 8, Miami, Florida, FL 12345

Size: 3 sq. mt.

Price: $200 per sq. mt. per week

Mobile Food Truck

Mobile Food Truck Rental in Miami – Start Serving Today! Looking to kickstart your food business or host an event? Our fully-equipped mobile food truck is available for weekly rental in Miami, making it easy to bring your culinary vision to life.

Features: Professionally designed kitchen with essential appliances and ample workspace.

Flexibility: Rent by the week—perfect for pop-ups, events, or market testing.

Prime Location: Operate in Miami’s bustling neighborhoods and attract a vibrant customer base.

Ready to Go: Inspected, clean, and ready to hit the road immediately.

Extras: Add-on options like permits and branding support available.

Don’t wait—secure your food truck rental today and start cooking up success!

- Custom

First-Time Renter Discount: Enjoy 10% off your first weekly rental.

Weekend Startup Deal: Start your rental on a Friday and get the entire weekend at no extra cost!

Referral Perk: Refer another renter and both of you receive $50 off your next rental. - Rent

Extended Rental Bonus: Rent for 4 weeks or more and get an additional week free.

Incentives

Collins Ave., Miami, Florida, FL 12345

Size: 800 sq. ft.

Price: $800 fixed price per month

Five Stars Hotel Office Room

Elevate your business experience with our hotel office room, available for monthly rental. Perfect for remote work, small meetings, or traveling professionals, this private, fully furnished space combines luxury with functionality.

Private Workspace: A comfortable and quiet environment for work, calls, and meetings, offering complete privacy.

Modern Amenities: High-speed Wi-Fi, office desk, ergonomic chair, and a telephone line for business use.

Access to Hotel Services: Room service, on-site restaurant, fitness center, and concierge support for a convenient and efficient workday.

Prime Location: Located in a central area of Miami, with easy access to business districts, dining, and shopping.

Flexible Terms: Rent monthly for added flexibility without long-term commitments.

Rent your hotel office room today and enjoy the comfort and convenience of a professional, all-in-one workspace!

- Custom

Complimentary Breakfast: Enjoy a daily free breakfast at the hotel’s restaurant for the first 30 days of your rental (tea, or coffee included).

- Rent

First-Month Discount: Sign a 3-month lease and get 20% off the first month’s rent.

- Service Charges

All-Inclusive Monthly Fee: Standard service charge of $150 per month, which includes high-speed internet, cleaning, and utilities.

- Voucher

Incentives

1110 Brickell Street Southeast, Brevard County, Florida, 32909

Size: 8,400 sq. ft.

Price: $3,878,325

Office Building

Seize this rare opportunity to own a premium office building in the heart of Miami's thriving commercial hub. Whether you’re an investor or a business owner seeking a strategic location, this property delivers exceptional value and unmatched potential.

Property Highlights:

Strategic Location: Located in Miami's bustling business district, surrounded by major corporations, retail, and transportation hubs.

Modern Design: Stylish and functional architecture with [insert details: e.g., glass facades, open layouts, contemporary interiors].

Flexible Space Options: Ideal for corporate headquarters, coworking spaces, or multi-tenant use with a mix of office sizes to suit various needs.

Convenient Parking: Ample on-site parking with easy access for clients and employees.

Amenities: [Insert features like conference rooms, on-site gym, rooftop terrace, café, etc.] to enhance work-life balance.

High Investment Potential: Positioned in a growing market with strong demand for commercial properties.

This property offers the perfect balance of functionality, luxury, and profitability, making it an unmissable opportunity for savvy buyers.

Contact us today to schedule a viewing and make this landmark office building yours!

- Custom

Complimentary property management services for the first year to ensure a seamless transition.

Incentives

9th Street, Miami, Florida, FL 12345

Size: 2,000 sq. mt.

Price: $50 per sq. mt. per annum

Warehouse

Looking for flexible warehouse space in Miami? Our fractional warehouse rental options allow you to share high-quality, secure storage and work space with other tenants at a fraction of the cost.

Modern Facility: Spacious, secure warehouse with loading docks and access to forklifts.

Long-Term Flexibility: Rent for the year and enjoy predictable, low overhead with shared use of space.

Prime Location: Centrally located in Miami with easy access to major highways, ports, and airports.

Shared Amenities: Utilities, security, and maintenance services included in your rent.

Additional Options: Ability to expand space or add equipment based on your needs.

Book your fractional warehouse space today and streamline your business operations in a convenient and cost-effective environment!

- Custom

Additional Space Deal: Rent a fractional space and add an extra 500 sq. ft. for free for the first 6 months.

- Rent

Early Bird Discount: Sign a yearly lease 3 months in advance and receive 10% off your first year’s rental.

Incentives

Ocean Drive, Miami, Florida, FL 12345

Size: 10 - 300 desks

Price: $200 - $350 per desk per month

Office Space for Rent by Desk

Looking for a professional workspace without the overhead? Our fractional office space in Miami offers the perfect solution! Rent by the desk on a monthly basis and enjoy a productive, collaborative environment.

Flexible Rentals: Rent individual desks per month, perfect for freelancers, startups, or remote teams.

Prime Location: Situated in the heart of Miami with easy access to transit, cafes, and business hubs.

Modern Amenities: High-speed internet, conference rooms, printers, and fully furnished workstations.

Collaborative Community: Network with like-minded professionals in a shared office setting.

All-Inclusive Pricing: Utilities, cleaning, and security included in your monthly rent.

Join a community of professionals in a dynamic office space – book your desk today!

- Custom

Referral Reward: Refer a colleague or business and both of you will receive $100 off your next month's rent.

- Rent

First-Month Discount: Get 15% off your first month’s desk rental!

- Service Charges

Long-Term Commitment Discount: Rent for 6+ months and receive a 10% discount on monthly service charges.

Incentives

Marina Lane, Miami, Florida, FL 12345

Size: 50 desks

Price: $3,000 per desk per annum

Luxurious Office

Elevate your workspace to a new level with our premium office space in Miami, available for annual desk rentals. Designed for professionals seeking a sophisticated, comfortable, and productive environment.

Prime Location: Situated in a prestigious Miami business district, close to dining, shopping, and transit.

Comprehensive Amenities: High-speed Wi-Fi, state-of-the-art conference rooms, 24/7 access, and personalized mail handling.

Professional Atmosphere: Network with top professionals in a vibrant yet exclusive setting.

All-Inclusive Package: Includes utilities, cleaning, and office supplies – no hidden fees.

Commit to excellence in a workspace that reflects your professional aspirations. Secure your desk today and work in luxury all year!

- Custom

Networking Perk: Receive complimentary access to exclusive office networking events during your first year.

- Rent

Group Desk Discount: Rent 3 or more desks together and get an additional 5% off each desk’s rental.

Early Renewal Bonus: Renew your lease 60 days before it expires and get one free month. - Service Charges

All-Inclusive Fee: Standard service charge of $120/month per desk covers utilities, high-speed internet, and cleaning.

Incentives

Lincoln Rd, Miami, Florida, FL 12345

Size: 2,800 sq. ft.

Price: $200,000 fixed price per annum

Bar

Step into history and charm with this old-style, cool bar available for annual lease. Perfect for entrepreneurs looking to create a distinctive nightlife experience, this venue offers vintage ambiance with modern convenience.

Classic Charm: Rustic interiors featuring exposed brick, wooden beams, and vintage decor.

Turnkey Ready: Fully equipped bar with seating, sound system, lighting, and kitchen space.

Prime Location: Situated in a lively Miami neighborhood with excellent foot traffic and visibility.

Customizable Space: Adaptable layout to suit your theme or event plans.

Ample Amenities: Includes on-site storage, restrooms, and staff facilities.

Don’t miss the chance to operate your dream bar in this iconic venue. Lease it for the year and bring your vision to life!

- Custom

Grand Opening Assistance: Receive free promotional support, including digital marketing and event planning, to help with your launch.

Decor Credit: Get a $1,000 credit towards customizing or refreshing the bar's vintage decor. - Rent

Multi-Year Commitment: Lock in your lease for 2 years and enjoy a 15% discount on the second year’s rent.

First-Month Free: Secure your annual lease and get your first month rent-free as a welcome bonus.

Incentives

Flagler St, Miami, Florida, FL 12345

Size: 500 - 1,000 sq. ft.

Price: $10 per sq. ft. per annum

Beauty salon

Stylish Beauty Salon for Annual Rental – Ready for Your Business!

Turn your beauty vision into reality with this fully equipped beauty salon, available for annual lease. Perfectly designed for hair, makeup, nails, and spa treatments, this space offers everything you need to build your dream business.

Modern Design: Sophisticated interiors featuring high-end furnishings, elegant lighting, and relaxing ambiance.

Prime Location: Situated in a high-traffic Miami area, ideal for attracting a steady flow of clients.

Fully Equipped: Includes styling stations, mirrors, wash basins, storage, and client seating areas.

Convenient Features: Reception desk, break room, restroom facilities, and ample parking for clients.

Turnkey Ready: Move in and start your business with minimal setup required.

Don’t miss the opportunity to operate a thriving beauty salon in Miami. Secure your lease today and make it yours for the year!

- Custom

Training Room Access: Enjoy 5 hours of complimentary use of the salon’s training or conference room.

- Rent

Long-Term Lease Savings: Commit to a 2-year lease and receive a 15% discount on the second year’s rent.

- Service Charges

Reduced Monthly Fees: Standard service charge of $300/month (covers utilities, cleaning, and maintenance), with a 5% discount if prepaid annually.

Incentives

How to list

Create your listing

It’s very simple, quick and easy to create an interesting, dynamic listing. To achieve the maximum success, please ensure all listings are complete with accurate and detailed information.

We also recommend professional photography as it enhances the quality of all listings.

Publish your listing

Once you have completed all the above steps you listing is ready to go live.

Check all details are accurate and correct and then hit the publish listing button and your listing is made live.

Manage your listing

You are in full control of all aspects of your listing.

You are able to create, edit and delete your listing at any time.

Please note: There is zero tolerance for false, misleading or inaccurate listings.

News & Articles

Adapting to evolving commercial space needs in Florida: 2019 to 2024

Over the past five years, the landscape of commercial real estate in Florida has undergone significant transformation. Shifts in consumer behaviors, technological advancements, and global events like the COVID-19 pandemic have altered the demands for office spaces, hospitality venues, leisure facilities, and medical centers. For real estate developers, understanding these trends is crucial to creating adaptable, profitable, and future-ready spaces. 1. Office spaces: from traditional to hybrid work models The office sector has experienced a seismic shift, driven by the rise of hybrid work models. Pre-2020, Florida’s thriving business hubs, such as Miami, Tampa, and Orlando, saw steady demand for traditional office spaces. However, the pandemic accelerated remote working, leading to a reevaluation of office requirements. Key trends include: Flexible office designs Companies now prefer adaptable layouts that accommodate in-person collaboration, hot-desking, and private meeting spaces. Co-working spaces, such as WeWork and Industrious, continue to expand to cater to startups and freelancers. Suburban growth Suburban office developments are in higher demand as employers seek to reduce commutes and align with employees' preferences for work-life balance. Technology integration Smart offices with robust internet infrastructure, touch-less entry, and wellness features are now standard expectations. 2. Hotels and hospitality: experiential and sustainable focus Florida's tourism industry remains a cornerstone of its economy, but travelers' expectations have evolved. Post-2019, there’s a greater emphasis on health, wellness, and unique experiences. Experiential stays Boutique hotels and themed accommodations are thriving as travelers seek more personalized and memorable stays. Properties near natural attractions, such as the Everglades or Florida Keys, are particularly popular. Wellness tourism Wellness-oriented resorts offering spa services, yoga retreats, and eco-conscious amenities have grown. Sustainability Developers are incorporating green building practices, energy-efficient systems, and sustainable landscaping to appeal to eco-conscious travelers and meet state regulations. 3. Leisure: mixed-use developments lead the way The leisure industry has seen a convergence of retail, dining, and entertainment in mixed-use developments. Projects like Miami's Brickell City Centre and Tampa's Water Street reflect this trend. Family-friendly venues Developers are investing in spaces that cater to multigenerational audiences, such as arcades, bowling alleys, and escape rooms, integrated with dining and shopping options. Outdoor spaces Outdoor dining, live music venues, and open-air markets surged in popularity during the pandemic and remain a draw for residents and tourists alike. Event-ready spaces Florida’s role as a destination for conferences and events has revived interest in adaptable venues that can host both large gatherings and intimate experiences. 4. Restaurants and bars: a new age of dining Florida’s dining scene has pivoted toward innovative formats and customer-focused offerings. Casual dining dominance Fast-casual and quick-service restaurants have outperformed traditional sit-down establishments due to convenience and affordability. Ghost kitchens The rise of delivery apps has fueled demand for ghost kitchens—commercial kitchens without customer-facing dining areas—especially in urban centers. Experiential dining Themed restaurants and bars that offer interactive experiences, such as rooftop bars or speakeasies, are drawing clientele seeking entertainment alongside their meals. Outdoor dining Permanent outdoor dining areas, initially a pandemic measure, have become a long-term feature for many establishments. 5. Medical centers: growth fueled by demographics and technology Florida's growing and aging population has heightened demand for medical facilities. Advances in healthcare technology and a focus on patient-centered care are shaping the development of these spaces. Outpatient centers Freestanding emergency rooms and outpatient clinics are being prioritized over traditional hospital expansions due to cost efficiency and convenience. Specialized facilities Developers are investing in specialized facilities, such as oncology centers, diagnostic labs, and mental health clinics. Telemedicine infrastructure Medical offices now require enhanced technological capabilities to support telemedicine consultations and digital health monitoring systems. 6. Mixed-use and transit-oriented developments An overarching trend across all sectors is the rise of mixed-use developments, particularly those near transit hubs. These projects integrate residential, commercial, and leisure spaces, creating vibrant communities where people can live, work, and play without excessive commuting. Adaptability is key Spaces that can be reconfigured for multiple uses will retain value and relevance in the face of market changes. Technology and sustainability Smart building features and eco-friendly practices are now competitive necessities. Community-centric design Projects that prioritize community engagement and offer diverse amenities will appeal to Florida's dynamic and growing population. The commercial real estate market in Florida remains robust, but the priorities of tenants and end-users have shifted. Developers who can anticipate and adapt to these evolving needs will be well-positioned for success in the years ahead. This article was commissioned by soCommercial – the market place for business space.

The decline of traditional leases: embracing the simplicity of flexible hybrid workspaces

The commercial real estate industry is undergoing a profound transformation as traditional long-term leases give way to the rise of flexible hybrid workspaces. This shift, driven by changes in workplace culture, technological advancements, and economic pressures, has ushered in a new era where simple agreements, rather than multi-page legal contracts, define the leasing process. For real estate professionals, this evolution represents both a challenge and an opportunity to adapt to the changing demands of tenants. The fall of the traditional lease For decades, the commercial real estate market relied on multi-year leases that required significant legal involvement. These agreements were often cumbersome, involving: Extensive negotiations between tenants and landlords. Complex legal language requiring interpretation by attorneys. Significant upfront costs, including legal fees and security deposits. Rigidity, locking tenants into spaces that might no longer meet their needs as businesses evolved. However, this traditional leasing model is increasingly at odds with today’s fast-paced, technology-driven business environment. Companies now prioritize flexibility, scalability, and simplicity, making the old leasing model appear antiquated. The drivers behind the shift Several factors have contributed to the decline of traditional leases: The Rise of Hybrid Work Models The pandemic permanently altered how people work. Remote work and hybrid models have become the norm, reducing the need for large, static office spaces. Businesses no longer want to commit to 10-year leases for offices they may not fully utilize. Instead, they seek: Short-term agreements that allow for scaling up or down. Access to shared spaces for occasional in-person collaboration. A focus on amenities that enhance employee well-being and productivity. Economic Uncertainty The global economy has experienced significant turbulence in recent years, from the pandemic to inflation and market volatility. Businesses are reluctant to take on long-term financial commitments like traditional leases when flexibility can offer cost savings and agility. Technology and the Gig Economy Advances in technology have made it possible for businesses to operate from virtually anywhere. Additionally, the rise of the gig economy means a growing number of entrepreneurs, freelancers, and small businesses require flexible workspace solutions rather than traditional leases. The Evolution of Real Estate Offerings Providers of coworking and flexible office spaces, such as WeWork, Industrious, and Regus, have set a new standard for how commercial spaces are leased. These providers offer month-to-month agreements or short-term contracts with minimal legal requirements, reshaping tenant expectations across the industry. Flexible hybrid workspaces: the new norm Flexible hybrid workspaces represent a radical departure from traditional leasing models. These spaces are designed to accommodate changing business needs, providing tenants with the ability to scale their usage up or down as required. The hallmarks of this model include: Simplicity Leases are often reduced to one or two pages, eliminating the need for extensive legal review. Ease of Entry Tenants can often secure space with minimal upfront costs and a quick approval process. Flexibility Agreements are typically month-to-month or short-term, allowing businesses to adapt as needed. Turnkey Solutions These spaces are move-in ready, often furnished and equipped with high-speed internet, shared meeting rooms, and other amenities. Community and Networking Opportunities Hybrid workspaces foster collaboration and networking among tenants, creating a vibrant ecosystem of businesses. Why simple agreements work One of the most attractive aspects of flexible workspaces is the simplicity of their agreements. These agreements are typically designed to be: Transparent Clear, straightforward terms reduce the risk of disputes and misunderstandings. Efficient Without the need for extensive legal negotiation, deals can be closed quickly. Cost-Effective Businesses save on legal fees and other costs associated with traditional leasing. For landlords and space providers, these simplified agreements streamline operations and attract a broader range of tenants, from startups to established enterprises. The legal implications: do we still need lawyers? While flexible workspace agreements significantly reduce the need for legal involvement, they don’t eliminate it entirely. Legal expertise remains valuable for: Ensuring compliance with local regulations and zoning laws. Protecting landlords and tenants from liability. Drafting master agreements that can be easily customized for individual tenants. However, the reduced complexity of these agreements means that legal costs are significantly lower, benefiting both parties. Challenges and considerations for real estate developers The transition to flexible hybrid workspaces presents challenges for developers accustomed to traditional leasing models. Key considerations include: Revenue Predictability Short-term agreements can create revenue volatility compared to the steady income of long-term leases. Developers must find ways to balance flexibility with financial stability. Space Utilization Efficiently managing shared spaces, such as meeting rooms and common areas, is critical to ensuring tenant satisfaction and maximizing profitability. Differentiation As the market for flexible workspaces grows, developers must offer unique amenities and services to stand out. This might include wellness programs, state-of-the-art technology, or premium locations. Scalability Developers need to design spaces that can be easily reconfigured to meet changing tenant demands, from private offices to open coworking areas. The future of leasing: a win-win for tenants and landlords The move toward flexible hybrid workspaces reflects a broader trend of consumer-centric real estate. Tenants benefit from the freedom and agility to operate on their terms, while landlords attract a diverse pool of tenants and reduce vacancy rates. This new model also aligns with broader societal shifts toward minimalism and sustainability. Smaller, more efficient office spaces reduce waste and carbon footprints, aligning with the values of modern businesses and employees. Conclusion The era of traditional leases is rapidly fading, replaced by the simplicity and flexibility of hybrid workspaces. For real estate developers, this is an opportunity to innovate and meet the needs of a dynamic, evolving market. By embracing short-term agreements, turnkey solutions, and tenant-friendly practices, developers can position themselves for success in this new landscape. As the industry continues to evolve, one thing is clear: simplicity, flexibility, and adaptability are no longer optional—they are the keys to the future of commercial real estate. This article was commissioned by soCommercial – the market place for business space.

The rise of flexible commercial spaces: a creative approach to commercial real estate

The commercial real estate landscape is undergoing a seismic shift. Gone are the days when single-use, single-purpose buildings dominated the market. The demand for versatile, flexible spaces that can cater to a variety of needs has emerged as a defining trend, driven by changes in work culture, consumer behavior, and economic imperatives. This evolution requires creativity and strategic planning to ensure that commercial spaces remain relevant and profitable in an increasingly dynamic market. The forces driving change Several key factors are propelling the transition away from traditional, purpose-specific buildings toward multi-use, adaptable spaces: Shifts in work culture The rise of hybrid work models and remote work has diminished the demand for conventional office spaces. Instead, businesses seek dynamic environments that can flex between co-working hubs, meeting venues, and collaboration zones. This shift challenges traditional office building designs and demands innovative reconfigurations to optimize utility. Changing retail landscape E-commerce's exponential growth has disrupted the retail sector, leaving many brick-and-mortar stores struggling. As a result, retail spaces are increasingly being repurposed for alternative uses such as fitness centers, popup shops, or entertainment venues. This trend is especially pronounced in shopping malls, which are reimagining themselves as multi-use hubs with residential, retail, and recreational spaces under one roof. Urbanization and space efficiency In densely populated urban areas, the scarcity of land makes multi-purpose spaces more economically viable. Mixed-use developments, combining residential units, offices, and retail outlets, are becoming the norm. This approach maximizes land use while fostering vibrant, 24/7 communities. Economic resilience Multi-use properties offer a financial hedge for investors and developers. Diversified revenue streams from tenants in different industries reduce the risk of vacancies tied to market downturns in a single sector. Creative repurposing: the key to unlocking potential The pivot toward flexible commercial spaces necessitates out-of-the-box thinking. Developers and property managers must creatively reimagine how their spaces can serve diverse purposes. Here are some approaches that have proven successful: Adaptive reuse Transforming obsolete structures into modern, multi-purpose spaces is a popular strategy. For example, old warehouses are being converted into trendy co-working spaces or art galleries. Similarly, vacant big-box stores are being adapted into logistics hubs, healthcare clinics, or even residential units. Pop-up opportunities Pop-up installations allow businesses to test ideas or operate in a space temporarily, often without requiring significant structural changes. This trend has proven successful in retail, food and beverage, and even experiential marketing events. Technology-driven flexibility Smart building technologies, including modular walls and multi-functional furniture, enable spaces to be easily reconfigured to meet changing needs. A conference room today can serve as a yoga studio tomorrow, thanks to these innovations. Community-centric design Mixed-use developments that incorporate communal amenities—like green spaces, shared kitchens, or event venues—create vibrant ecosystems that appeal to a wide demographic. These designs ensure steady foot traffic and enhance tenant satisfaction. Future Considerations As the trend toward flexible commercial spaces accelerates, developers and stakeholders must address key challenges: Balancing cost and creativity While innovative designs and repurposing projects can be lucrative, they often come with high initial costs. Striking the right balance between investment and potential returns is critical. Navigating zoning and regulations Many urban areas still operate under zoning laws that were written with single-use buildings in mind. Policymakers and developers must collaborate to modernize regulations that allow for more creative, multi-use developments. Sustainability as a priority Sustainable design is no longer optional. From energy-efficient materials to eco-friendly construction practices, the demand for green spaces is shaping the future of commercial real estate. Flexible spaces that prioritize sustainability will have a competitive edge. Conclusion The shift toward flexible commercial spaces represents an exciting evolution in real estate. By embracing adaptability and creative design, developers can future-proof their investments while meeting the diverse needs of modern businesses and communities. As the lines between work, play, and living continue to blur, the demand for spaces that reflect this fluidity will only grow. The key to success lies in bold innovation and a willingness to reimagine what a commercial space can be. This article was commissioned by soCommercial – the market place for business space.

Maximizing profit: the commercial opportunity of shared commercial spaces

In a rapidly evolving economy, the adage "less is more" has taken on a new meaning in the realm of commercial real estate. Businesses and property owners are increasingly recognizing the untapped potential of underutilized commercial spaces. Whether it's an office with too many empty desks, a retail store with underused backrooms, or a restaurant with downtime during the day, sharing commercial spaces has emerged as a lucrative and sustainable model. This trend is redefining how businesses think about property utilization, creating new revenue streams while fostering collaboration and innovation. The case for sharing commercial spaces The concept of shared spaces isn't new. Co-working spaces, such as WeWork and Regus, have been pioneers in turning vacant offices into thriving hubs for freelancers, startups, and remote workers. However, the model has now expanded beyond co-working to encompass a wider variety of commercial settings. The driving forces behind this shift include rising real estate costs, changing work patterns, and a growing focus on sustainability. Rising real estate costs Commercial property prices and rents have been steadily increasing, particularly in urban areas. For many businesses, owning or leasing a space is a significant financial burden, often leaving them with little choice but to leave parts of their property unused. Sharing spaces can offset these costs by generating additional income from tenants who need temporary or flexible arrangements. Changing work and consumer patterns The pandemic accelerated the adoption of remote work, e-commerce, and flexible schedules, leaving many traditional offices and retail spaces partially empty. These shifts have created an opportunity to rethink how spaces are used. For instance, an office could rent out unused meeting rooms to small businesses, or a retail store could lease its storage area to an online retailer needing a distribution point. Sustainability and efficiency Environmental concerns are another driving factor. Sharing spaces promotes better resource utilization, reducing the need for new construction and the associated environmental impact. By maximizing the use of existing infrastructure, businesses can lower their carbon footprints and align with growing consumer demand for sustainable practices. Opportunities across industries The potential for shared commercial spaces spans multiple industries, each with its unique set of opportunities. Retail Retailers can transform underutilized floor space into revenue-generating areas. For example, a boutique might host pop-up shops for emerging brands or rent space to local artisans. These arrangements not only generate income but also draw new customers, creating a win-win situation. Hospitality Restaurants and cafes, which often experience downtime during non-peak hours, can lease their spaces for events, workshops, or even co-working. Similarly, hotels can rent out conference rooms or unused spaces to small businesses or community groups. Offices With hybrid work models becoming the norm, many companies find themselves with surplus office space. By partnering with co-working operators or offering short-term leases to freelancers and startups, these companies can turn empty desks and meeting rooms into steady revenue streams. Warehousing and logistics As e-commerce continues to grow, the demand for storage and distribution hubs has surged. Businesses with spare warehouse space can lease it to smaller companies needing storage solutions, particularly in prime urban locations where logistics facilities are in high demand. The rise of technology-driven solutions Technology plays a crucial role in enabling the sharing of commercial spaces. soCommercial now makes it super easy for property owners and stakeholders to list available spaces and for businesses to find and book them. These digital marketplaces streamline the process, offering features like flexible booking, transparent pricing, and user reviews. In addition to listing platforms, property management tools equipped with data analytics can help businesses track space usage, identify inefficiencies, and determine the best opportunities for sharing. For example, sensors and smart software can monitor foot traffic and occupancy, providing insights into when and where space is being underutilized. Benefits beyond revenue While the financial benefits of sharing commercial spaces are clear, the advantages extend far beyond the bottom line. Community building Sharing spaces fosters collaboration and builds a sense of community among businesses and individuals. This can lead to partnerships, networking opportunities, and even customer growth as businesses cross-promote to each other's audiences. Flexibility and scalability For startups and small businesses, shared spaces offer an affordable and low-risk way to access premium locations without committing to long-term leases. This flexibility can be a game-changer, allowing businesses to scale up or down based on demand. Innovation and creativity Mixing diverse businesses in shared spaces often sparks innovation. For example, a graphic design studio renting space from a marketing firm could lead to collaborative projects and fresh ideas. Challenges and considerations While the benefits are significant, sharing commercial spaces does come with challenges. Property owners and tenants must navigate potential conflicts over usage, maintenance, and liability. Clear agreements and transparent communication are essential to ensuring a smooth partnership. Regulatory hurdles can also pose obstacles. Zoning laws and building codes may limit how spaces can be used or require additional permits. Businesses must be proactive in understanding and complying with these regulations. Finally, not all spaces are suited for sharing. Factors such as location, accessibility, and amenities play a crucial role in determining whether a space can attract tenants or partners. The path forward As the sharing economy continues to expand, the concept of shared commercial spaces is poised to become a mainstream business strategy. Property owners who embrace this model can unlock new revenue streams, while businesses seeking flexible solutions can access premium spaces at lower costs. Moreover, the emphasis on sustainability and community-building aligns with broader societal trends, making this approach not just profitable but also socially responsible. For companies and entrepreneurs looking to explore this opportunity, the key is to think creatively and strategically about how their spaces can serve others. Whether it's a corner office, a storage room, or a dining area, every square foot holds the potential to create value. In an era where adaptability is paramount, sharing commercial spaces offers a compelling solution to maximize resources and drive growth. It’s not just about filling empty rooms—it’s about transforming the way we think about space, collaboration, and the future of business. This article was commissioned by soCommercial – the market place for business space.

The changing face of Florida's commercial real estate market: 2000 to 2024

The Florida commercial real estate market has undergone significant transformations since the turn of the 21st century. As one of the fastest-growing states in the U.S., Florida’s evolution in demographics, economic drivers, technology, and market dynamics have reshaped its commercial real estate landscape. This article explores the factors influencing these changes over the last two decades, focusing on population growth, shifts in market demand, technological advancements, and the growing emphasis on sustainability. Population growth and urbanization One of the most significant factors shaping Florida’s commercial real estate market is its population growth. Between 2000 and 2023, Florida’s population surged from approximately 16 million to over 22 million, making it the third most populous state in the U.S. The state’s attractive climate, lack of state income tax, and reputation as a retirement haven have drawn both retirees and younger, economically active populations from across the country. This population growth has driven demand for diverse commercial real estate assets, particularly in major urban centers like Miami, Tampa, Orlando, and Jacksonville. While the early 2000s saw suburban expansion, the past decade has been marked by a trend toward urbanization, with mixed-use developments and urban infill projects catering to a growing preference for live-work-play environments. Tourism and retail evolution Florida’s tourism industry has long been a pillar of its economy, with destinations like Disney World, Miami Beach, and the Florida Keys attracting millions of visitors annually. However, the nature of retail and hospitality assets has evolved significantly since 2000. The early 2000s were dominated by the construction of large retail centers and malls. However, with the rise of e-commerce and changing consumer habits, many traditional malls faced decline or repurposing in the 2010s. Developers pivoted to open-air shopping centers, entertainment districts, and mixed-use developments. Tourist-centric retail spaces such as the Miami Design District and ICON Orlando have emerged as experiential destinations combining luxury retail, dining, and entertainment. The COVID-19 pandemic accelerated some of these shifts, leading to the repurposing of retail spaces for last-mile logistics centers, ghost kitchens, and other uses aligned with the digital economy. The hospitality sector, initially devastated by the pandemic, has rebounded strongly, with renewed investment in boutique hotels and short-term rental properties catering to changing traveler preferences. The rise of industrial real estate One of the most dynamic areas of Florida’s commercial real estate market has been the rise of industrial real estate. Fueled by the growth of e-commerce and Florida’s strategic location as a gateway to Latin America and the southeastern U.S., demand for warehouse and logistics facilities has soared. Major infrastructure investments, including the expansion of the Panama Canal and improvements to Florida’s ports in Miami, Tampa, and Jacksonville, have bolstered the state’s role in global trade. This, in turn, has spurred the development of industrial hubs around key transportation corridors. As of 2023, the industrial sector is among the fastest-growing asset classes in Florida, with vacancy rates at historic lows and rental rates climbing steadily. Office market transformations The Florida office market has undergone a profound transformation over the past two decades, reflecting broader economic trends and workplace changes. In the early 2000s, office development centered on suburban business parks. However, as Florida’s cities became more cosmopolitan, demand shifted toward urban office spaces in vibrant downtown areas. The rise of remote and hybrid work models, accelerated by the pandemic, has created challenges for traditional office spaces. Many companies downsized or reconfigured their office footprints to accommodate flexible work arrangements. In response, developers have increasingly focused on adaptive reuse projects, converting outdated office buildings into residential or mixed-use spaces. The tech sector’s growth in cities like Miami, buoyed by an influx of entrepreneurs and venture capital, has added a new layer of demand for modern, high-tech office spaces. Co-working spaces, once niche, have also become a fixture in Florida’s commercial real estate market, catering to startups and remote workers. Multifamily housing as a commercial asset While traditionally considered a residential asset, multifamily housing has become a cornerstone of Florida’s commercial real estate market. The influx of new residents, coupled with rising home prices, has fueled demand for rental properties. Institutional investors have increasingly targeted Florida’s multifamily market, attracted by strong rent growth and low vacancy rates. Developments have evolved to include luxury apartments, affordable housing projects, and workforce housing to accommodate a diverse renter base. Cities like Orlando and Miami have seen a proliferation of high-rise multifamily developments, often integrated with retail and office spaces. Sustainability and resilience Florida’s susceptibility to hurricanes, flooding, and rising sea levels has made sustainability and resilience critical considerations for commercial real estate. Since 2000, the state has adopted stricter building codes and incentivized sustainable construction practices. Developers increasingly incorporate green building certifications such as LEED into projects, and resilient design features—like elevated structures, floodproofing, and renewable energy systems—have become standard in coastal areas. This focus on resilience has also influenced investment patterns. Institutional investors now assess climate risks more rigorously, and some are favoring inland areas over vulnerable coastal regions. The role of technology Technology has been a game-changer for Florida’s commercial real estate market. Innovations in construction technology, property management, and data analytics have streamlined operations and improved efficiency. Proptech platforms have made it easier for investors to analyze market trends, while smart building technologies enhance tenant experiences and reduce operating costs. Florida’s emergence as a tech hub, particularly in Miami, has also contributed to the market’s dynamism. The influx of tech companies and remote workers has driven demand for modern office spaces, high-speed internet infrastructure, and amenities catering to a tech-savvy population. Investment trends and outlook Florida’s commercial real estate market has attracted substantial domestic and international investment over the past two decades. While the early 2000s were characterized by speculative development, the market has matured, with investors focusing on long-term value and stable income-producing assets. The rise of private equity and real estate investment trusts (REITs) has also played a significant role, bringing institutional capital into Florida’s market. Cities like Miami have become global investment destinations, attracting capital from Europe, Latin America, and Asia. Looking ahead, Florida’s commercial real estate market is poised for continued growth. The state’s favorable tax environment, population growth, and economic diversification provide a strong foundation for future development. However, challenges such as climate change, affordability, and infrastructure constraints will require innovative solutions from policymakers and industry stakeholders. Conclusion The Florida commercial real estate market has undergone a remarkable transformation since 2000, driven by population growth, shifting economic trends, and evolving consumer preferences. From the rise of industrial real estate to the reinvention of retail and office spaces, the market reflects the dynamic interplay of local and global forces. As Florida continues to grow and evolve, its commercial real estate sector will remain a bellwether for broader economic and social trends, offering both challenges and opportunities for investors, developers, and communities. This article was commissioned by soCommercial – the market place for business space.

Analyzing the Impact of Changing Uses in Commercial Real Estate Across U.S. States

SoCommercial believes that the shifting dynamics of commercial real estate across the United States are reshaping the industry’s landscape. This transformation stems from evolving economic trends, demographic shifts, and technological advancements, which have impacted different states in varied ways. By examining the changing uses of commercial real estate, we can understand the states most affected and the reasons behind these shifts. The Driving Forces Behind the Changes Several key factors are driving the transformation of commercial real estate: Remote Work and Office Space Decline The COVID-19 pandemic catalyzed a rapid adoption of remote work. As a result, many businesses have downsized their physical office spaces, leading to a surplus of office buildings in urban centers. E-Commerce Boom The rise of online shopping has shifted demand from traditional retail spaces to industrial real estate, such as warehouses and distribution centers. Population Shifts Migration trends, particularly from high-cost coastal cities to more affordable regions, have influenced real estate markets. States with growing populations see increased demand for mixed-use developments that combine residential, commercial, and recreational spaces. Sustainability and Technology The push for green buildings and smart technology integration has altered the design and use of commercial properties. States Most Impacted by the Changes While these trends have affected the entire country, some states stand out due to the magnitude and nature of the changes: California California, a historical hub for technology and innovation, has experienced a significant shift in commercial real estate. High costs of living and business operations have prompted many companies to downsize or relocate. The Bay Area, in particular, has seen an exodus of tech firms moving to states like Texas and Florida, leaving behind vacant office spaces. Texas In contrast, Texas has emerged as a beneficiary of these shifts. Cities like Austin and Dallas have become hotspots for corporate relocations, driving demand for office spaces, industrial properties, and mixed-use developments. The state’s business-friendly environment and affordable living costs make it attractive for both companies and workers. New York New York’s commercial real estate market has been hit hard, particularly in Manhattan. The decline in demand for office spaces and the slow recovery of the retail sector have left landlords struggling to adapt. However, the city’s resilience lies in its capacity for reinvention, with a focus on converting office buildings into residential or mixed-use properties. Florida Florida has seen a surge in demand for commercial real estate, fueled by population growth and an influx of businesses. Miami, in particular, has become a hub for fintech and other industries, driving demand for modern office spaces and co-working environments. Midwestern States States like Ohio and Indiana have experienced growth in industrial real estate due to their central locations and accessibility to transportation networks. The shift toward e-commerce has led to a boom in warehouses and distribution centers in these areas. Why These States Have Been Most Affected The impact on these states can be attributed to several factors: Economic Policies States with favorable tax policies and incentives for businesses have seen increased investment in commercial real estate. Population Growth: Regions experiencing an influx of residents require new infrastructure, including retail spaces, offices, and mixed-use developments. Industry Presence: States with thriving industries, such as tech in Texas and finance in Florida, have experienced tailored demand for specific types of properties. Cost of Living and Quality of Life: Affordability and lifestyle amenities attract workers and businesses alike, shifting the demand for commercial spaces. The Road Ahead SoCommercial believes that the ongoing evolution of commercial real estate is a reflection of broader societal changes. While some states grapple with declining office occupancy and retail closures, others are capitalizing on the rise of remote work and e-commerce. The key for stakeholders is to adapt to these changes by repurposing properties, embracing sustainability, and leveraging technology to meet the needs of a dynamic market. As the commercial real estate landscape continues to shift, the industry’s future will depend on its ability to innovate and respond to these transformative trends. By staying attuned to the unique challenges and opportunities in each state, businesses and investors can navigate this evolving terrain with confidence. This article was commissioned by soCommercial – the market place for business space.